At this very moment, I’m ordering my coffee from Black Sheep Coffee in Chelmsford – double-caffeine and everything.

It has become the in-vogue thing to do amongst financial social media stars such as Kevin O’Leary, Graham Stephan, etc, to comment on the cost of coffee and how detrimental it is to wealth-building.

This article will reveal the truth of the matter.

We Love Coffee

In the UK, we drink, on average two cups of coffee a day. In the US, it’s an average of three a day. I was actually amazed at how much coffee we drink.

Starbucks, the biggest coffee chain, has around 38,000 locations, which is incredible, and plans to have 55,000 stores open by 2030. I wouldn’t be surprised in the slightest if Starbucks hits its goals in this regard, as the company has remarkable financials and an incredible brand. On Starbucks loyalty cards alone, there is an unspent balance of over one billion dollars.

The industry as a whole is thriving, but is it at our expense? People spend, on average around $20 on coffee a month in cafes and an additional $11-30 on coffee prepared at home. To be honest, I’m surprised that the spending isn’t greater, but it is clear that there is an increasing trend. According to a report carried out by Beans Coffee Club, the average UK consumer spent £530 a year on coffee in 2023. These figures seem to align fairly well and agree on the general trend and amount.

The Cost of Coffee

The Finfluencers seem to have two main threads to their arguments:

The first is that the present cost per cup of coffee, especially from a cafe is significant and expensive.

I’d certainly agree with this assessment. The price of coffee has risen in the UK by on average 7.6-16.5 percent per month between 2022 and 2023. Many factors determine the price of coffee such as fuel prices, droughts in coffee-growing countries, labour costs, etc. There are also significant differences in coffee prices from chain to chain and country to country.

If we assume that the average coffee spend per year is £530 and the median annual net income in the UK is £27,573, people are devoting around 1.9% of their income to coffee. This might not seem a lot, but if your budget is squeezed and you are having trouble with debt, the high cost of housing, or have little left over to contribute to savings or investments, then around 2% could be significant.

The Time Value of Money

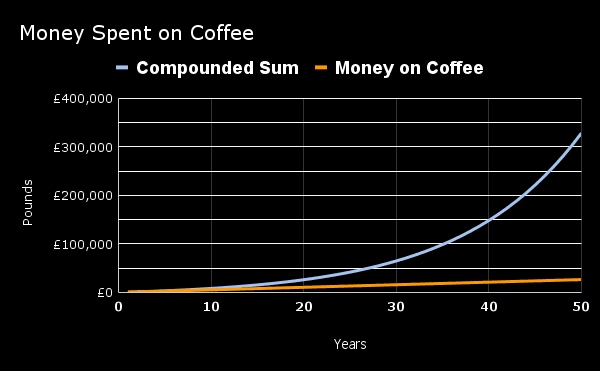

The second reason why finfluencers seem concerned about the cost of coffee is related to the time value of money. The time value of money is simply the idea that the present value of a sum of money is worth more than that same sum of money in the future. This is because a present sum can be invested and be worth more in the future. For instance, if we invest £5 at an 8% rate of return over 30 years, we would have around £50, minus the inflation rate (the growth rate tends to outweigh the rate of inflation).

This means that when we buy a cup of coffee, there is an opportunity cost that we don’t see, so we are actually spending more than we think. If we were to take that £550 pounds annually and invest it over 50 years at a conservative 8% return, we would have an ending amount of £328,426.04, despite only investing £26,500 across the lifetime of the investment.

Whilst the mathematics is undeniable, I wouldn’t wish for anyone to think that is anything wrong with spending money on a coffee or to feel guilty about having one if it is a justifiable expense. It is worth considering that the average retirement savings in the US is around $333,940 – and this is certainly not enough.

This figure is remarkably close to the figure that people would be able to accumulate by foregoing coffee to increase their investment rate.

Budget in Your Coffee

I will not stop buying coffee, because I have built discretionary spending into my personal budget, however, writing this blog article has certainly provided me with pause for thought about the affect that small reductions in spending could potentially produce over time.

My advice, is if you have less than £100,000 in savings and investments (not including your home), or a significant debt pile, is to cut down on cafe bought coffee, and buy a good quality French Press or Aeropress (we use it all the time). Over the long haul, you’ll definitely find it to be a worthy investment.

Conclusion

Overall, it appears that coffee is a significant cost in our everyday lives, but if you can maintain a significant investment and savings rate, and make most of your coffee at home, it is not something we ought to cut out of our lives for financial reasons.

I am a huge fan of coffee and a prolific coffee drinker. The hours of valuable time that I spend in coffee shops working also should be taken into consideration – people might not make as much money if they are not able to boost their energy levels with coffee.

Well-run coffee chains are no doubt going to profit massively over the next 10 years from the growth in consumer demand, their ability to price competitively, and source their coffee efficiently and sustainably. I’m certainly taking a look at Starbucks (SBUX) as a great potential stock pick with exciting growth prospects.