Did you know that reaching your first £100,000 could be the most challenging step in your wealth journey?

Money attracts money—it’s a phrase often tossed around, but why does it hold?

Is it just about financial growth, or does something deeper come into play? This blog will dive into the fascinating mechanisms behind wealth-building, from the mathematical magic of compound interest to the ripple effects of mindset and opportunity.

It will also shed some light on:

- Compound Interest

- The Law of Attraction

- Unfair Advantages

- The Matthew’s Effect.

Why Does Your Net Worth Rockets After £100,000?

Please note that any information supplied on this website is for entertainment purposes only and should not be taken as financial advice. Any reader should do their own research and/or consult with a qualified financial advisor.

Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.”

These words reflect a key principle of wealth-building: making your money work for you. But why does reaching £100,000 feel like a pivotal milestone in achieving financial independence?

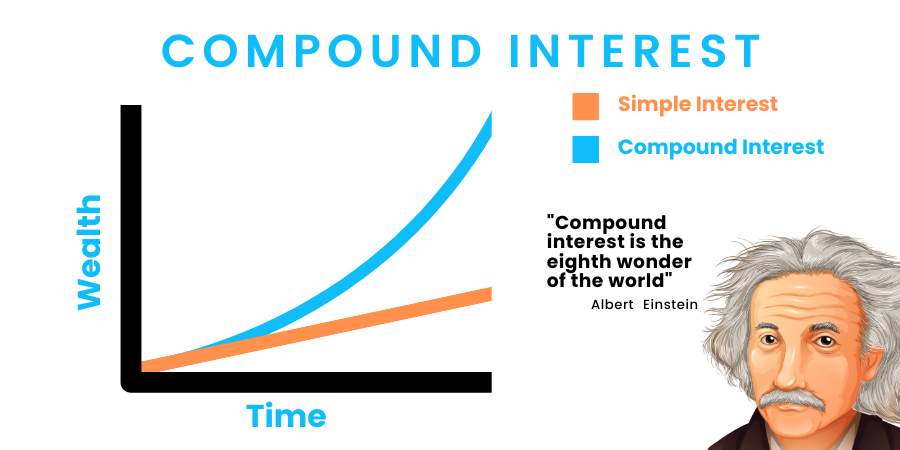

When I was 9 or 10 years old, my mum introduced me to the concept of compound interest. She explained that if she were to invest £3,000 at an annual rate of 4% for three years, she could grow her savings without lifting a finger. The idea that the bank would pay you for saving money left me fascinated and planted the seed for one of the most powerful principles of wealth creation: compound interest.

Legendary investor Charlie Munger often stresses the importance of hitting that first £100,000, saying, “I don’t care what you have to do-if it means walking everywhere and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on $100,000.”

Why such urgency? Because money grows faster when you have more of it.

The Power of Scale: Bigger Numbers, Bigger Returns

Let’s compare two scenarios:

- Invest £10,000 at an 8% annual return, and over a decade, your money will grow to £21,589. It’s a good return, but put into perspective, it is not life-changing.

- Start with £100,000. The same growth rate of 8% would equate to £215,890 after a decade, which opens a whole new world of possibilities.

It still is a growth rate, yet the difference in the outcome is extreme, as the larger your starting capital, the greater the effect of compounding.

The difference becomes even more extreme after some time. In 30 years:

- £10,000 grows to approximately £100,000.

- £100,000 rises to more than £1,000,000.

Starting with £100,000 provides a big head start and makes it much easier to achieve seven figures.

Smaller sums compound at the same rate but take a very long time to become meaningful.

If you want to visualise your wealth growth over time, check out my free investment growth visualiser.

The Difficulty in Achieving Your First £100,000

The most challenging part of building wealth is reaching your first big milestone. Whereas compounding loves time and patience, this phase requires the opposite-active effort:

- Boost Your Income: Seek opportunities to increase your earnings during your early career.

- Budget Aggressively: High saving and investment rates are non-negotiable.

- Trim Non-Essentials: Yes, that includes cutting back on small luxuries like daily coffee orders.

Once you reach £100,000, the process starts to snowball. The pathway to wealth becomes more about consistency than sacrifice as earnings are reinvested, and your money works harder for you.

Compounding small amounts, but getting up to six figures is a game-changer – it’s the point where money truly starts attracting more money.

Access to Opportunities

Having money can allow you to gain access to some opportunities which are not open to those with a lower net worth.

For instance, if you have £10,000, you would have limited access to property as an investment. You may be able to buy one small investment property in an area where property is cheaper and with less opportunity for capital appreciation.

These properties will likely be distressed (damaged), or in undesirable areas. Tenants are also likely to be more problematic, as they will probably be on low income or benefits.

With £100,000, you can explore more property options, possibly buying multiple properties. Areas with strong growth and good tenants may lead to increased profits, capital gains, and opportunities for future investments through remortgaging.

With a larger amount of money, you could even buy a distressed property and then use your cash reserve to improve the property’s condition, resulting in an instant profit when you remortgage (as long as you don’t overspend on the refurb).

Money and Mindset

This mathematical understanding of the compounding effect is something that anyone can understand with practice, but is something deeper, or spiritual implied by the phrase, “money attracts money”?

Does having money affect us in deep ways that can help us develop a better money mindset?

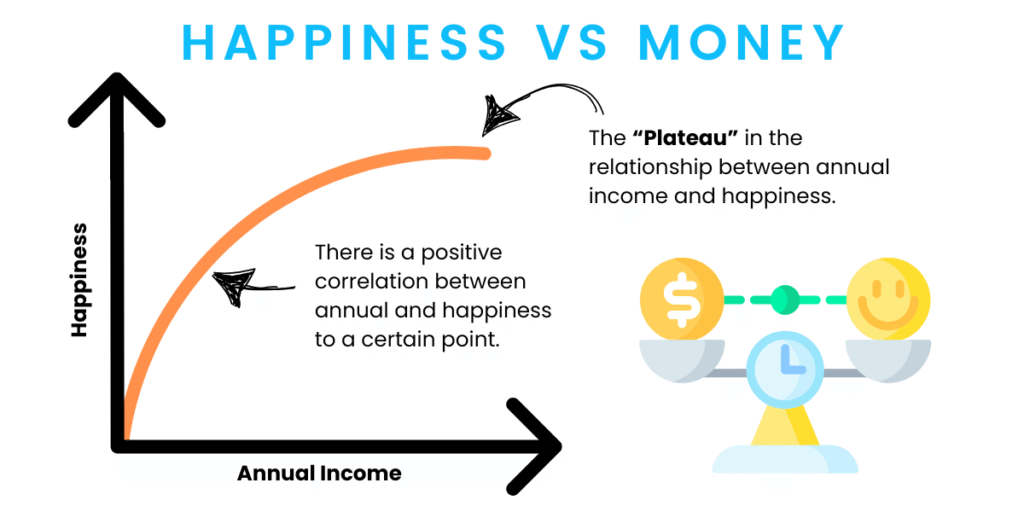

At a basic level, it has been shown that having money can increase happiness and life satisfaction. The effect seems to be linked to money increasing both our overall self-esteem and our social status. There is, however, a plateauing effect which occurs when our income reaches around $100,000 annually.

This relationship is probably something that varies according to the individual and their personality.

Nevertheless, it probably is true that there is a “happiness curve”, which levels out once someone has hit an almost arbitrary amount of income. This amount of income seems to depend on the country, social circles, personality factors and so on.

The Law of Attraction

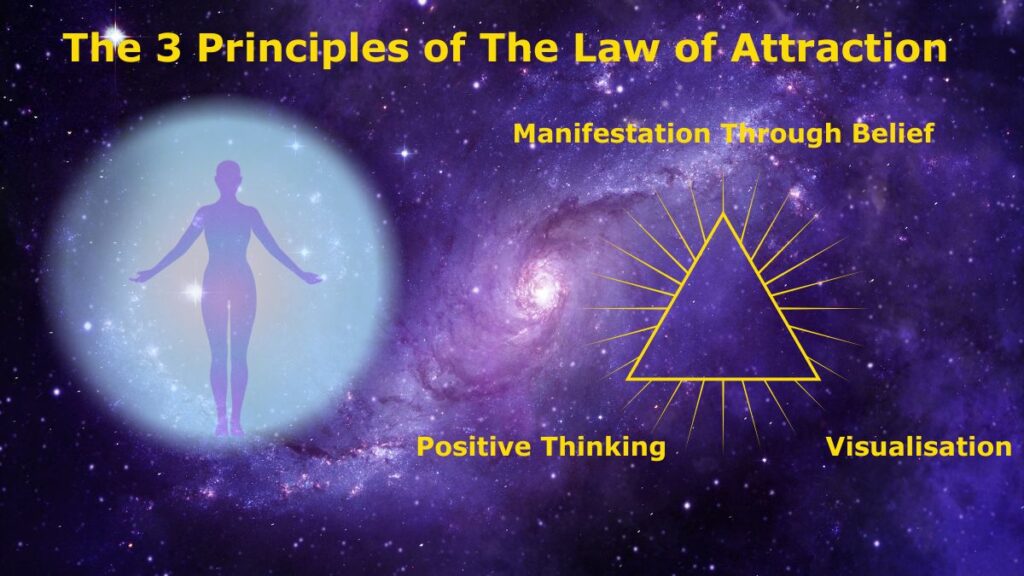

Some people take this idea of money attracting money into a spiritual realm. The law of attraction is a philosophical concept which expresses the idea that our thoughts and feelings influence our ability to attract abundance into our lives. Certain books such as The Secret Law of Attraction, aim to provide readers with techniques which build this positive mindset.

The 3 Principles of the Law of Attraction

The Law of Attraction is the philosophical view that our thoughts and feelings do affect our ability to attract abundance into our lives. While interpretations may vary, three core principles are often associated with the Law of Attraction:

Positive Thinking

Besides the Law of Attraction showing the power of positive thoughts, it encourages an optimistic outlook. Individuals maintain that processing positive sides attracts positive outcomes in life. This principle creates a mindset in alignment with desired goals and outcomes.

Visualisation

Visualisation involves creating mental images of desired outcomes. According to the Law of Attraction, vividly imagining success or achieving goals helps align the subconscious mind with one’s aspirations. By visualising positive scenarios, individuals aim to manifest those circumstances in reality, influencing their actions and decisions.

Manifestation through Belief

At the heart of the Law of Attraction is the idea that genuine belief in the attainability of goals increases the likelihood of manifestation. The law postulates that deep-seated conviction in the feasibility of one’s desires implores the universe with a powerful message, prompting it to align circumstances in favour of those beliefs.

Why the Law of Attraction is a Fishy Concept

I believe that the law of attraction is one of the strangest beliefs, both true and completely impossible to prove.

The most difficult of the three principles to accept is manifestation through belief. Positive thinking and visualisation certainly have an impact on what we can achieve, however, manifestation is an idea that is entirely spiritual in concept and therefore is not verifiable.

The immense power of the mind is evident when we take placebos. Placebo pills taken by cancer patients in a randomised study improved their condition and caused them to experience less fatigue.

Our body seems to respond positively to certain changes in our mind.

This mind-body connection seems to be the source of this belief in the law of attraction. However, there does not seem to be a way of justifying the spiritual link between having positive thoughts and the positive results we can achieve. This means that a book which is filled with spiritual mumbo-jumbo, may “work”, despite it being factually incorrect.

For instance, Napoleon Hill’s Think and Grow Rich contains a lot of seemingly random ideas and unfounded statements. On reading it, I thought it really expressed nonsense. I did, however, feel more confident in myself after reading it.

I think we can remain sceptical about the spiritual link between our thoughts and the results that we achieve in life. However, there does seem to be at least some evidence that positive thoughts can have positive effects on our life outcomes.

If you think about it, all wealthy people take calculated risks. To take risks in the first place, you need to be confident that you will achieve success. Some level of delusion is required for us to become successful.

Money as Proof of Competence?

Having money is a tangible way in which we can justify to ourselves that we are capable.

It can give us proof that we have expertise in a certain area. This expertise is also picked up by women, who tend to be hypergamous in their pursuit of partners.

This confidence can lead us to take more calculated risks to make more money and to take advantage of other opportunities. Although there is probably significant variance amongst individuals, there is scientific evidence that links millionaire status to increased appetite towards risk.

The Matthew’s Effect

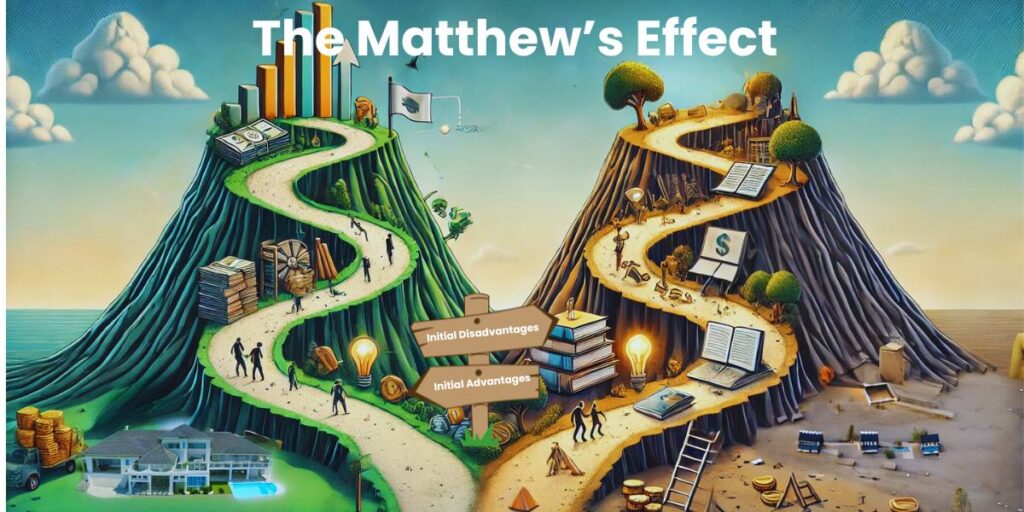

The Matthew Effect describes a phenomenon where initial advantages lead to further success, while initial disadvantages make improvement more challenging.

Advantages, whether financial or educational, create a positive feedback loop. This provides more opportunities and resources, which fosters confidence and a positive mindset.

Potentially, this leads to continued success.

Just to provide a little more context on this idea of life advantages leading to greater success, here is a real-life example of the Matthew’s Effect in practice. These examples also demonstrate that it is not just money that attracts money.

These so-called Unfair Advantages can also lead to incredible success:

Bill Gates: A Pioneer in Technology and Philanthropy

Early Advantage: Bill Gates had unique access to computers at a time when they were rare and inaccessible to most people. This early exposure sparked his fascination with programming and laid the foundation for his future success. He was also able to access the talent of Paul Allen, who was a computing genius.

The Matthew Effect: Gates’ early start and growing expertise in programming culminated in the creation of Microsoft. As Microsoft flourished, Gates became one of the richest individuals globally. This wealth enabled him to diversify his investments and channel significant resources into groundbreaking ventures and philanthropic initiatives, amplifying his impact on the world.

This example showcases how Gate’s early advantages or successes set him on a trajectory that leads to further opportunities, wealth accumulation, and influence. Of course, he had remarkable personal abilities and talent, but these opportunities were also the result of chance.

The Matthew Effect is evident in many founder’s stories, where initial accomplishments played a pivotal role in shaping their long-term success.

Summary

We’ve learned that initial advantages set the stage for more success over time. Think of it as a snowball effect—getting bigger as it rolls.

The mathematical reality of compounding growth can propel people towards riches over time. There are, however, other psychological reasons why money can attract money.

Understanding the link between money and mindset, we see that having money can boost confidence and encourage taking smart risks. Real-life examples prove that early advantages open doors to more opportunities. This trend is not just evident in money but in various aspects of life.

If you enjoyed this blog, join my mailing list for other posts like this one: